Desktop, Mobile & More

Digital banking offers the security of traditional banking plus more flexibility. Manage your accounts on the go with our mobile app, enroll today!

Personal Online Banking

Manage your finances easily with our Personal Online Banking. Access your accounts anytime, from anywhere with an internet connection and get added features like mobile deposit and Zelle® through mobile banking.

- Track Your Spending: Spending reports, transaction searches, and downloadable data.

- eStatements: Monthly account statements delivered through online banking.

- Online Bill Pay: Pay all your bills from a single, user-friendly website.

- NotifiSM Alerts: Receive email and/or text alerts on your account activity.

- Mobile Banking: Much of the functionality of online banking, right on your phone.

- Zelle®: A fast, safe and easy way to send money.

eStatements

Eliminate paper and simplify your life with eStatements. When you sign up, your monthly account statement will be delivered to you via your online banking account.

-

Receive your statements faster – no more waiting for them to arrive in the mail.

-

Eliminate paper clutter. You can download your eStatements or login to view several months’ worth of statements.

-

Rest assured that your financial information is safe – no more worries about your statements getting lost in the mail! Our web site is safe and secure.

-

Access your statement anytime via online banking from any device with Internet access.

Signing up is easy. From your online banking account, click Profile at the top of the page, then navigate to “Electronic Statements” and follow the instructions to enroll.

Online Bill Pay

Pay all your bills from a single, user-friendly website with just a few clicks through Online Bill Pay.

Features of Online Bill Pay include:

- Pay an unlimited number of bills

- Control when individual bills get paid

- Schedule one-time or recurring payments

- Access or print transaction histories and pending payments

Bill Pay FAQs

What kind of payments can I make with Bill Pay?

-

Bills

-

Send or receive payments with friends and family through Zelle®

-

Transfer funds to another bank*

-

Send a donation

-

Send a check

*Fees Apply

How much does Bill Pay Cost?

Capitol Bank’s Personal Bill Pay services are free of charge. Fees do apply to external bank transfers and rush payments.

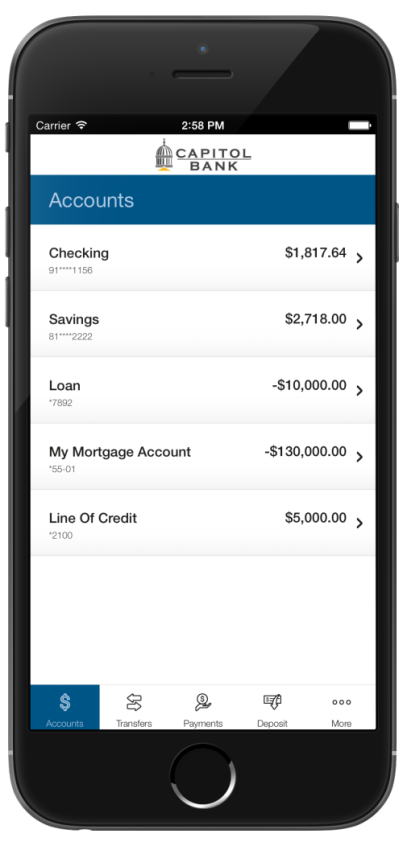

Mobile Banking

Perform many of the same tasks you would with online banking with our iOS and Android mobile apps. You’re also able to access your account through your mobile browser and through text messaging.

Mobile Browser and SMS Text Banking

Access your account through your phone’s browser or through text messages.

Enroll by logging in to online banking, selecting “Profile”, locate “Mobile Banking Profile,” and click “Enroll”.

Mobile Banking is the ultimate on-demand service. You can securely access your account information from any mobile phone with text messaging, mobile web access or through a downloadable app. You can download the app in either the Apple App Store for the iPhone® or Google Play for Android®.

You have the convenience of viewing your account balances, viewing and recent transactions, or transferring funds between accounts—all from your mobile phone. To pay your bills from your mobile phone you must be a Bill Pay subscriber, and the payees should already have been set up.

Is Mobile Banking Secure?

Mobile Banking employs industry best practices with regard to security. It has been assessed against industry security criteria by a number of independent system security experts. Capitol Bank uses "SecureNow". This layer of protection confirms not only your credentials, but also the device you are using during login. If the system detects a new device or suspicious activity, you may be asked to verify your identity with a one-time passcode sent to your phone. Given the importance of cybersecurity, this new feature will is mandatory for all personal online banking users.

At a high level, Mobile Banking offers the following security safeguards:

Authentication – Mobile browser and application solution customers are authenticated for every interaction with any Mobile Banking component. Customers are authenticated by username and password or by utilizing existing login credentials for single sign-on.

Encryption – 128-bit encryption is used for all transactions within Mobile Banking.

Fraud – Mobile Banking incorporates mechanisms such as transaction validation and transaction reconciliation processes to detect fraud.

Availability/Resilience – Mobile Banking is protected against malicious attacks through software and server hardening measures.

Audit Ability – Mobile Banking provides full audit capabilities through event logs and event-based reporting.

Mobile Deposit

Make deposits up to $5,000 per day—anytime, anywhere—with the Capitol Bank Mobile Banking app. It’s fast, easy, and convenient when time doesn’t allow you to stop into the bank.

A couple of tips when using Mobile Deposit:

- Before logging into the Mobile Deposit app, close all other apps running in the background on your mobile phone.

- Sign / endorse the back of check, and label it “For mobile deposit only at Capitol Bank.”

- The MICR line—numbers on bottom of check—should be readable.

- Destroy check after confirmation that the deposit has been posted.

- Enroll by logging in to online banking, selecting “options,” locate “Mobile Banking Profile,” and click “Enroll Now.”

Send and receive money fast with Zelle®

Now Available! We have partnered with Zelle® to bring you a fast, safe and easy way to send and receive money with friends, family, and other people you trust2

FAST

Send money directly from your account to theirs, typically in minutes3.

SAFE

Send and receive money with Zelle® right from Bill Pay online or our mobile banking app2.

EASY

Send money using just their U.S. mobile number or email address.

How to Start Using Zelle®

- Enroll or log in to Bill Pay

- Select “Send Money with Zelle®”

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

That’s it! You’re ready to start sending and receiving money with Zelle®.

Zelle® FAQs

What is Zelle®?

Zelle® is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes.3 With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank.2

Who can I send money to with Zelle®?

You can send money to friends, family and others you trust.2 Since money is sent directly from your bank account to another person’s bank account within minutes,3 it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number.

How do I enroll in and use Zelle®?

To get started, log in to Capitol Bank’s online banking or mobile app and navigate to the “Send Money With Zelle®“. To enroll, accept terms and conditions, tell us your email address or U.S. mobile number and deposit account, and then you will receive a one-time verification code, enter it and you’re ready to start sending and receiving with Zelle®

- To send money using Zelle®, simply add a trusted recipient’s email address or U.S. mobile phone number, enter the amount you’d like to send and an optional note, review, then hit “Send.” In most cases, the money is available to your recipient in minutes.3

- To request money using Zelle®, choose “Request,” select the individual(s) from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request.”4

- To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®.

Someone sent me money with Zelle®, How do I receive it?

If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your bank account and will be available typically within minutes.3

If you have not yet enrolled with Zelle®, follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select Capitol Bank.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification – you should enroll with Zelle® using that email address or U.S. mobile number where you received the notification to ensure you receive your money.

What types of payments can I make with Zelle®?

Zelle® is a great way to send money to family, friends and people you are familiar with such as your personal trainer, babysitter or neighbor.2

Since money is sent directly from your bank account to another person’s bank account within minutes,3 Zelle® should only be used to send money to friends, family and others you trust.

Neither Capitol Bank nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

How do I get started?

It’s easy – Zelle® is already available within Capitol Bank’s mobile banking app and online banking within Bill Pay! Check our app or sign in online and follow a few simple steps to enroll with Zelle® today.

What if I want to send money to someone whose financial institution doesn’t offer Zelle®?

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient’s financial institution isn’t on the list, don’t worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number and a VISA® or Mastercard® debit card with a U.S.-based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

How does Zelle® work?

When you enroll with Zelle® through your online banking Bill Pay account or mobile banking app, your name, the name of your financial institution and the email address or U.S. mobile number you enrolled is shared with Zelle® (no sensitive account details are shared – those stay with Capitol Bank).

When someone sends money to your enrolled email address or U.S. mobile number, Zelle® looks up the email address or mobile number in its “directory” and notifies Capitol Bank of the incoming payment. Capitol Bank then directs the payment into your bank account, all while keeping your sensitive account details private.

Can I use Zelle® internationally?

In order to use Zelle®, the sender’s and recipient’s bank accounts must be based in the U.S.

Can I cancel a payment?

You can only cancel a payment if the person you sent money to hasn’t yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel and then select “Cancel This Payment.”

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you aren’t able to get your money back, please call our customer service team at 608-836-1616 so we can help you.

Scheduled or recurring payments sent directly to your recipient’s account number (instead of an email address or mobile number) are made available by Capitol Bank but are a separate service from Zelle® and can take one to three business days to process.

You can cancel a payment that is scheduled in advance if the money has not already been deducted from your account.

How long does it take to receive money with Zelle®?

Money sent with Zelle® is typically available to an enrolled recipient within minutes.3

If you send money to someone who isn’t enrolled with Zelle®, they will receive a notification prompting them to enroll. After enrollment, the money will be available directly in your recipient’s account, typically within minutes.3

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle® and that you entered the correct email address or U.S. mobile phone number.

If you’re waiting to receive money, you should check to see if you’ve received a payment notification via email or text message. If you haven’t received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please contact our customer support team at 608-836-1616.

Will the person I send money to be notified?

Yes! They will receive a notification via email or text message.

Is my information secure?

Keeping your money and information safe is a top priority for Capitol Bank. When you use Zelle® within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe.

I’m unsure about using Zelle® to pay someone I don’t know. What should I do?

If you don’t know the person, or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle® for these types of transactions.

These transactions are potentially high risk (just like sending cash to a person you don’t know is high risk). Neither Capitol Bank nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

What if I get an error message when I try to enroll an email address or U.S. mobile number?

Your email address or U.S. mobile phone number may already be enrolled with Zelle® at another bank or credit union. Call our customer support team at 608-836-1616 and ask them to move your email address or U.S. mobile phone number to your financial institution so you can use it for Zelle®.

Once customer support moves your email address or U.S. mobile phone number, it will be connected to your bank account so you can start sending and receiving money with Zelle® through your Capitol Bank banking app and online banking. Please call our customer support team at 608-836-1616 for help.

Upon enrolling in Zelle®, if you don’t see your cell phone number listed, you can enroll with your email address. Additionally, if you already have two phone numbers associated with your account, it may not allow you to add an additional phone number upon enrollment. Therefore, you can enroll with your email address, then adjust your phone numbers within the Zelle® settings.